-

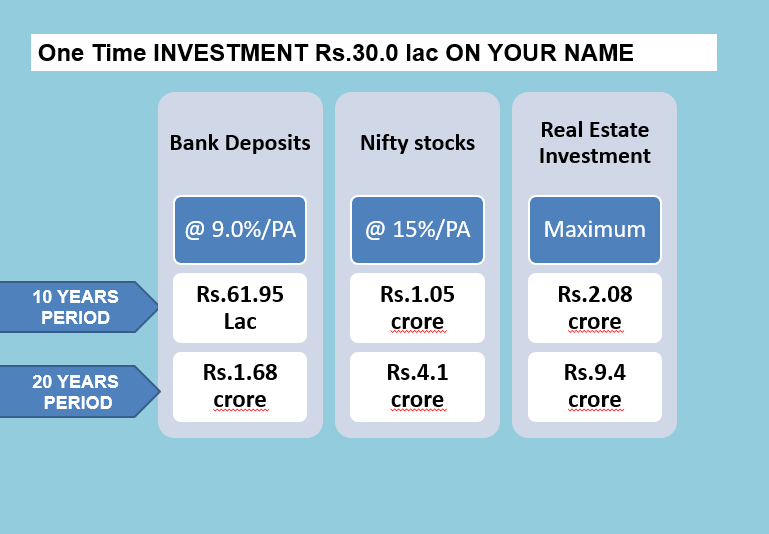

How much money do I need to invest one time?

The minimum one-time investment is Rs. 30.0 Lac, and there is no maximum limit. You can invest any amount at any time for a 20-year period.

-

Where should we invest?

Investment and returns will be generated through the buying and selling of apartments as and when required.

-

Is my amount safe for the next 20 years?

Yes, your investment will be made in your name. The purchased and sold flats will be registered under your name through a sale agreement.

-

How do we know our money is safe?

- An escrow/joint account will be created in a bank.

- You can track the money transfer status anytime during the 20-year period.

- The account will ensure complete transparency.

-

How many years do i need to wait to earn Maximum with small investment?

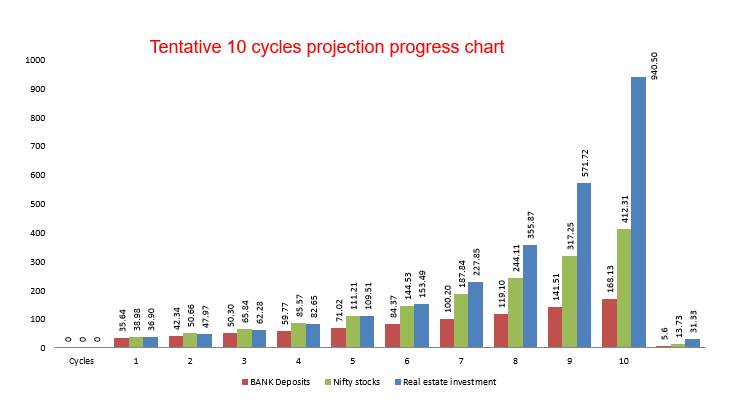

With a one-time investment of Rs. 30.0 Lac, you can expect returns up to Rs. 9.04 Crore for 20 Years. If a Financial crunch occurs during the period, it may take an additional 2 to 4 years to achieve.

-

Can I withdraw the amount during the investment period?

- There will be a lock-in period of 20 years. In case of an emergency, you can withdraw at any cycle closing time, after the deduction of charges such as unit transfer charges to the builder (3% to 5%) of the property value), brokerage charges 2% of the property value), and miscellaneous charges 2% of the property value

-

Who can invest? Can NRIs invest?

- No age limit.

- NRIs can also invest.

-

Are there charges to consultants/authorities?

Yes, applicable charges include:

- Franking charges, bank service charges, processing charges, pre closing charges approximate 3 to 4% paid to the bankers & venders.

- Brokerage charges 2% paid to the agents.

- Unit transfer charges 3-5% paid to the builders.

- Property/Investment management service charges 0.5% paid to us.

- Other applicable service charges to be paid if any.

-

Do I need to pay charges and taxes?

- No, all mentioned charges are covered by the investment process.

- However, investors are responsible to pay taxes on their amount such as:

- Capital Gains Tax, GST, TDS

- Income Tax, other taxes

-

What if natural calamities occur?

Regardless of any event (demonetizations, disasters, pandemics, wars, economic crashes), your initial investment remains safe.

-

Is there any insurance coverage for my investment?

Yes, your investment is covered by term insurance up to Rs. 1 crore for 20 years, provided by top insurance companies like ICICI and HDFC.

-

What is the procedure in case of death during the investment period?

In the event of natural death occurring after two years from the investment start date, the insurance coverage of Rs. 1 crore will be provided. The nominee can continue the investment process.

-

Is there a referral bonus available?

Yes, a referral bonus of 2% on the investment amount is available.

- 1st cycle – Rs. 30,000 OR

- 5th cycle – Rs. 2,00,000 OR After the 5th cycle, each cycle will yield as follows:

- 6th cycle – Rs. 2,00,000

- 7th cycle – Rs. 2,00,000

- 8th cycle – Rs. 2,00,000

- 9th cycle – Rs. 2,00,000

- 10th cycle – Rs. 2,00,000 OR After the

- 10th cycle, a total of Rs. 30,00,000 will be provided/-

-

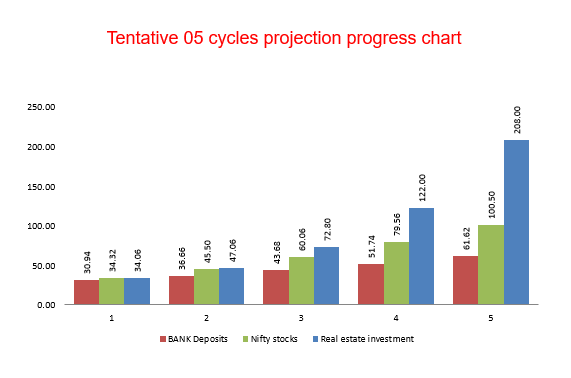

How do the 5 cycles or 10 cycles work out?

INVESTOR SERVICE PROVIDER 1st Cycle

The investor (first buyer) will purchase flats. The purchased flats will be registered to the investor through a sale agreement between the investor and the builder.The service provider will evaluate the market and decide on purchasing flats based on several key factors, including: - Reputation of the builders

- Location of the property

- Size of the project

- Total number of flats available

- Duration of the project

- Current competitive prices

- Expected future price appreciation

2nd Cycle - Selling and Reinvestment

The investor will sell the flats purchased in the first cycle to a new customer at a higher price. The newly purchased flats will be registered to the investor through a sale agreement between the investor and the builder.The service provider will decide: - The optimal time to sell the flats for the highest possible price

- The selling price based on market conditions

- After selling the flats at a higher price, the service provider will again determine:

- Where to buy new flats

- When to make the purchase

- What price to pay for the flats

3rd Cycle - Selling and Reinvestment (Repeat Process)

The investor will sell the flats purchased in the second cycle to another customer at a higher price. The flats purchased in this cycle will be registered to the investor via a sale agreement between the investor and the builder.The service provider will once again decide: - The right time to sell

- The optimal selling price

- After the sale, the service provider will determine:

- Where to buy the next set of flats

- When to buy them

- What price to pay for the flats

4th Cycle - Selling and Reinvestment

The investor will sell the flats purchased in the third cycle to another customer at a higher price. The newly purchased flats will be registered to the investor in a sale agreement between the investor and the builder.The service provider will evaluate market conditions and decide: - The best time to sell for maximum profit

- The appropriate selling price

- After the sale, the service provider will decide:

- Where to purchase the next set of flats

- When to buy them

- The price to offer for the flats

5th Cycle - Final Sale and Reinvestment

The investor will sell the flats purchased in the fourth cycle to a new buyer at a higher price. The new flats purchased in this cycle will be registered to the investor through a sale agreement between the investor and the builder.The service provider will evaluate the market and decide: - When to sell the flats for the highest return

- The price at which to sell the flats

- Following the sale, the service provider will again decide:

- Where to buy the next set of flats

- When to make the purchase

- The price at which to buy the flats

| ONE TIME REAL ESTATE INVESTMENT Rs.26.0 lac - RETURNS IN MULTIPLE 08 TIMES Rs.2.08 crore IN 10 YEARS | ||||

|---|---|---|---|---|

| Period in Cycle | BANK Deposits | Nifty stocks | Real estate investment | |

| 01 |

1.19

Rs.30.94 Lac

|

1.32

Rs.34.32 Lac

|

1.31 | Rs.34.06 Lac |

| 02 |

1.41

Rs.36.66 Lac

|

1.75

Rs.45.50 Lac

|

1.81 | Rs.47.06 Lac |

| 03 |

1.68

Rs.43.68 Lac

|

2.31

Rs.60.06 Lac

|

2.8 | Rs.72.80 Lac |

| 04 |

1.99

Rs.51.74 Lac

|

3.06

Rs.79.56 Lac

|

4.69 | Rs.1.22 Crore |

| 05 |

2.37

Rs.61.62 Lac

|

4.05

Rs.1.05 Crore

|

8.01 | Rs.2.08 Crore |

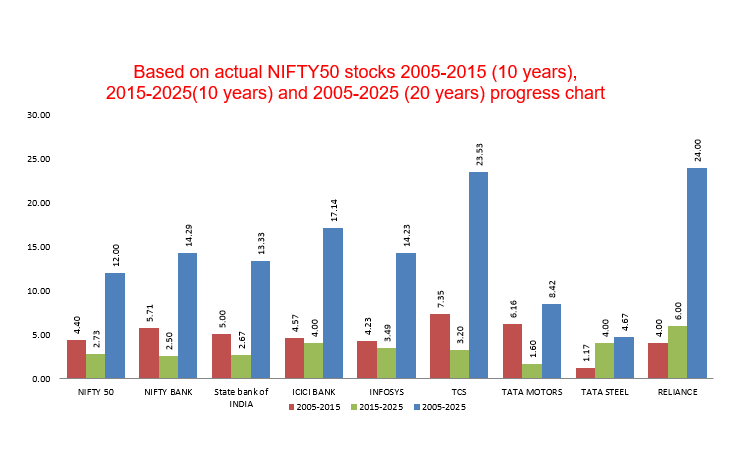

Top 5 Stock Growth Charts

Visual representation of the consistent growth of India's leading companies over previous years. These charts highlight the potential of long-term equity investments.

SBI

Infosys

TCS

ICICI Bank

ITC